How UAE Payroll Outsourcing Helps Companies Pay International Employees

by Ishika Bhandari Nov 27, 2025  5 MIN READ

5 MIN READ

Table of contents

- Why Does Cross-Border Payroll Get Tricky for UAE Companies?

- What Happens if UAE Companies Pay Overseas Employees Incorrectly?

- The Role of UAE Payroll Outsourcing

- When You Need International Payroll Solutions

- How a UAE Company Can Pay International Employees?

- When to Choose an Arnifi EOR Service?

- Pros and Cons of Each Method

- How ArnifiHR Helps UAE Companies Manage Global Payroll?

The potential for companies in the UAE to extend their operations to search for international talent has popularized hiring employees outside of the UAE. However, doing so isn’t uncomplicated because paying foreign workers doesn’t mean that they can be included in a local payroll system. They have distinct regulatory, tax, and compliance obligations that come with every country. This is where UAE payroll outsourcing and international payroll structuring meet to build a compliant and reliable payment system for global teams.

Why Does Cross-Border Payroll Get Tricky for UAE Companies?

Managing cross-border payroll involves navigating multiple layers of international regulations. UAE businesses often run into challenges such as:

1. Different Tax Rules

The employee comes under the tax rules of his home country. The laws, obligations, and deadlines for filing differ for each employee’s home country. Ignoring the local limitations, a UAE firm will more likely not end up in under- or overpayment of taxes.

2. Social Security Obligations

Whether or not they have mandatory contributions from both employer and employee to a social security scheme varies among countries. Penalties should be imposed on noncompliance, apart from other compliance violations.

3. Misclassification Risks

Hiring an overseas international worker as an “independent contractor” by a UAE company when it doesn’t meet the legal conditions may result in reclassification penalties or lawsuits faced by the company.

4. Local Employment Regulations

The countries differ greatly when it comes to work hours, paid leave, notice periods, and termination rules. A foreign employee can have a contract annulled for the wrong application of UAE labor laws.

5. Currency and Payment Restrictions

Certain countries impose tight inbound currency rules or require salaries to be paid in local currency. This complexity hinders the payment of international employees through the bank accounts of the UAE.

These complexities make it clear that managing payroll globally requires specialized expertise and reliable systems.

What Happens if UAE Companies Pay Overseas Employees Incorrectly?

Incorrect payroll administration concerning employees abroad may lead to:

- Fines and penalties for wrongful practice

- Once reporting is mismanaged, double taxation arises

- A contract is deemed illegal, which invalidates the contract

- Banking and AML issues, especially concerning payments abroad

- Flagged restrictions in certain jurisdictions on hiring

For companies that want to build long-lasting global teams, these risks make a compliant payroll system inevitable.

The Role of UAE Payroll Outsourcing

This is where UAE payroll outsourcing becomes a strategic advantage. It allows you to rely on professionals who know both UAE regulations and international compliance needs rather than managing multi-country payroll in-house.

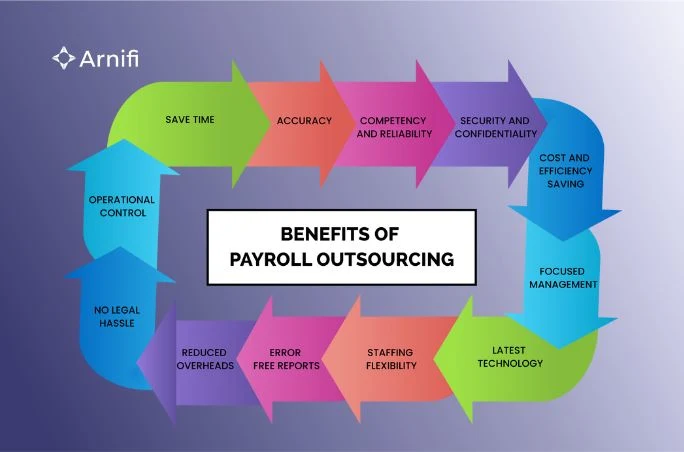

Outsourced payroll providers are helpful in:

- Accurate payroll calculations

- Compliance oversight of UAE regulations

- Proper documentation and record-keeping

- Facilitating salary transfers, local and international

- Management of multi-country payroll through integrated systems

Traditional outsourcing was set up primarily for employees based in the UAE. However, modern providers now extend this to global hiring, with integration into international payroll solutions.

When You Need International Payroll Solutions

To be able to truly streamline payroll globally, organizations generally complement outsourcing with a specialized international payroll solution. Such systems help UAE companies in the following ways:

- Pay international employees their local and foreign currencies

- Manage the tax and social security obligations abroad

- Consolidate multi-country payroll into one dashboard

- Continuous compliance monitoring

- Automate payroll workflows and reporting

When managing employees in so many countries, especially high-regulation regions such as the EU, UK, or Asia, such tools become critical.

How a UAE Company Can Pay International Employees?

Here is a quick step-by-step guide for UAE businesses wanting to legally pay international employees from the UAE:

Confirm status: employee or contractor

Each country has set criteria defined, and misclassification can result in penalties.

Check legal obligations in the employee’s country

Taxes, laws, minimum wage, and socials are to be included.

Choose between in-house, outsourcing, or EOR/global payroll

Your structure depends on the number of employees as well as compliance risks.

Set up compliant contracts

Contracts should follow the worker’s employment laws within his or her country, and not UAE laws.

Configure international payroll systems

This ensures automated deductions, filings, and payments.

Use approved methods for salary transfers

Avoid manual transfers but rely on regulated payroll payment gateways.

Maintain documentation and compliance audits

These records will save the company in cases of tax or labour audit.

When to Choose an Arnifi EOR Service?

An EOR is the easiest “go-to” option for hiring full-time employees abroad without opening a local entity. It has become the legal employer and handles requirements of compliance, payroll, contracts, and tax filing, while the UAE company turns into a manager of daily tasks.

EORs complement the outsourced per-payroll model and even the global payroll platforms, making it ideal for smaller teams or ramping up quickly across multiple countries.

Pros and Cons of Each Method

| Method | Pros | Cons |

| Direct Payments | Simple; no third-party fees | High compliance risk; no tax or legal support |

| UAE Payroll Outsourcing | Local compliance + documentation support | Limited for multi-country payroll unless integrated |

| International Payroll Solutions | Full global payroll, currency, and tax coverage | Requires configuration and ongoing oversight |

| Employer of Record | Easiest global hiring model; zero entity setup | Higher per-employee cost |

How ArnifiHR Helps UAE Companies Manage Global Payroll?

Arnifi supports the UAE businesses through every stage in hiring and paying foreign employees by the following:

- Creating payroll structures compliant with the law

- Profiling companies on cross-border hiring requirements

- Assessing, recommending, and implementing the proper international payroll solutions

- Managing all compliance, documentation, and payroll workflows from the UAE side

With ArnifiHR, companies stand to minimize compliance risks and maximize global-hiring efficiencies at the same time. Ready for simplification in global payroll? Contact Arnifi to get started.

Top UAE Packages

Related Articles

Top UAE Packages