Smart Salary Planning in UAE: Budgeting Tips Backed by HR Experts like Arnifi

by Shethana Jul 17, 2025  6 MIN READ

6 MIN READ

Struggling to manage your income in the UAE? Here is how people budget better, avoid financial mistakes, and how Arnifi supports smart payroll solutions. Whether you are an employee trying to stretch his or her salary or an employer whose goal is to contribute to the financial well-being of employees, it is important to know about planning, saving, and managing income in the fast-paced UAE economy of today. From furnishing destinations in rent and lifestyle expenses to knowing where their deductions disappear, salary planning strengthens one’s financial sustainability.

Table of contents

- The Real Reason Budgeting Matters in the UAE

- Let Us Break Down That Pay check

- Why UAE Life Needs a Budget Strategy

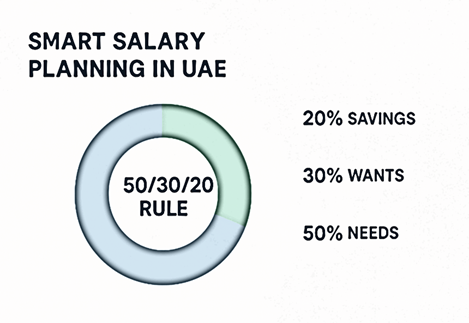

- The 50/30/20 Rule That Just Works

- What a Typical Budget Looks Like in the UAE

- Tools That Help You Stay on Track

- Where People Go Wrong with Budgeting

- How Arnifi Supports Financial Wellbeing

- What Arnifi Really Offers Employers

- Final Thoughts | Taking Ownership of Your Finances

The Real Reason Budgeting Matters in the UAE

Living in the UAE is exciting; there is no doubt about that. But let us be real: it is also expensive. Whether you are paying for rent in Dubai or grabbing coffee in Abu Dhabi, the costs add up fast. Most people get their salary tax-free, which sounds great on paper. But without a clear plan, that money can vanish before you even realize it. That is why budgeting is not just a finance trick and it is a survival skill here.

Let Us Break Down That Pay check

Think about it. You work hard, the salary lands in your account and then what? If you are not tracking where it is going, it starts to disappear little by little. Salary planning just means being clear about your income and what you need to spend it on. No need for fancy formulas. It is about figuring out what matters most to you includes rent, savings, fun and giving each one a slice of your pay check.

Why UAE Life Needs a Budget Strategy

Salaries are tax free in the UAE, but that does not mean it comes cheap. Many expats swiftly recognize the upside, in that rent, schooling, transportation, and entertainment will splurge on their earnings.

Here are just a few of the average monthly bills billed to many:

• Rent (1 BHK or studio): AED 3,500–6,000

• Groceries and dining out: AED 800–1,200

• Transport: AED 300–800

• Phone and internet: AED 300–600

• Eating out and entertainment: AED 500–1,000

Once you add it all up, nearly nothing is left to save or put aside for an emergency. Budgeting will keep you out of any such surprises.

The 50/30/20 Rule That Just Works

Here is a simple budgeting technique many UAE residents follow:

• 50% Needs: Rent, bills, transport

• 30% Wants: Eating out, shopping, subscriptions

• 20% Savings: Emergency funds, investments, future objectives.

The rule is flexible and easy. Whether you are making AED 8,000 or AED 20,000 a month, breaking it into these categories should be the way forward towards clarity and stability.

What a Typical Budget Looks Like in the UAE

Reem is a content manager in Dubai earning AED 11,000 per month:

• Needs (50%) → AED 5,500 (rent, utilities, transport)

• Wants (30%) → AED 3,300 (entertainment, shopping, eating out)

• Savings (20%) → AED 2,200 (travel, emergency fund)

With these categories clear upfront, Reem can study her spending monthly and retain financial stability to keep away from debt. Budgeting enables her to save money for larger items such as studying overseas or beginning a business.

Another instance is Ahmed, a junior designer who gets AED 9,000. He keeps rent down by sharing a living space with flatmates and likes to keep active using public transport. His budget looks like this:

- Needs: AED 4,000

- Wants: AED 2,500

- Savings: AED 2,500

He is saving aggressively for a down payment on a car next year.

Tools That Help You Stay on Track

There are many free and paid tools that make budgeting simpler:

- Wally: Great for local currency tracking (AED), connects to bank accounts.

- Spendy: Visual graphs and alerts, great for tracking categories.

- YNAB (You Need a Budget): Ideal for long-term goals and planning.

These applications can motivate you, display you with weekly reports, and notify you when overspend. Most importantly, by automating the maths, they reduce the stress associated with budgeting. You can also use good old spreadsheets or Google Sheets. It is not about the tool it is about being consistent.

Where People Go Wrong with Budgeting

Some common mistakes many fall into:

- Ignoring small, frequent expenses

- Not saving for yearly costs (like visa or car insurance)

- Using credit cards without planning repayment

- Skipping emergency funds entirely

Other issues include:

- Making a budget once and never updating it

- Setting unrealistic saving targets

- Not involving the whole household (if married or living with family)

Tip: Review your budget once a month. Adjust for new expenditure, saving objectives, or income changes.

How Arnifi Supports Financial Wellbeing

Forward-thinking companies today care about employee wellbeing, not just salaries.

Here’s how Arnifi helps employers support their teams:

- Delivers salaries on time, always

- Provides guidance on compliant salary structuring

- Helps companies educate employees on money management

They also offer:

- Personalized support to HR teams

- Advice on legally optimized salary components (like allowances,

- housing, etc.)

Employees are happier, more stable, and less stressed when the employers provide this kind of support.

What Arnifi Really Offers Employers

Arnifi is a trusted Employer of Record (EOR) in the UAE. That means they help companies:

- Hire and manage employees locally

- Handle payroll and government compliance

- Support onboarding, HR functions, and employee services

For small businesses and startups, Arnifi can serve as a full HR partner. For large companies, they streamline complex workforce processes. From remote worker administration to gratuity calculations for right proper gratuity, to abiding by all MOHRE guidelines, Arnifi solutions allow it to be easy to do that which would otherwise be intimidating.

Final Thoughts | Taking Ownership of Your Finances

Let us be realistic by making money is one thing, but sustaining it is where the real challenge comes. You do not need a finance degree to budget. You just need to have a general understanding of what you are being paid, what you are spending and what your priorities are. Budgeting does not mean putting your life on hold or sacrificing the things that bring you joy. It is about planning for them so that you will not worry about them later. Even saving a small amount each month will prove worthwhile in the end. And the good news? You do not have to do it alone. Companies like Arnifi are stepping up and assisting employees not just with pay checks, but with real dollars and care to build a brighter financial future.

Find out how at arnifi.com

Top UAE Packages

Related Articles

Top UAE Packages