Exploring Free Zone Rules in Dubai: A Comprehensive Guide

by Shethana Sep 22, 2024  10 MIN READ

10 MIN READ

Eager to explore the free zone rules in Dubai?

Dubai’s Free Zone system is a key part of the emirate’s economic plan. It aims to attract foreign investment and diversify the economy. Free Zones provide a special business setting that has its own rules and regulations. Businesses here enjoy a lot of freedom. They also gain access to top-quality infrastructure, helpful regulations, and a strategic location for global trade.

Each Free Zone is managed by its own authority. These authorities issue licenses, supervise rules, and offer support to businesses. Each Free Zone focuses on specific industries like technology, media, or logistics.

The Evolution of Free Zones in the UAE

The UAE started its journey with Free Zones in 1985 when it opened the Jebel Ali Free Zone (JAFZA). This important step aimed to use the UAE’s strategic location to create a nice place for business. The goal was to attract companies from around the world and help economic development. JAFZA’s success led to the growth of Free Zones in the UAE.

The UAE government understands how important Free Zones are for economic growth. So, they have kept supporting their development. New Free Zones have been created, each focusing on different industries and promoting new ideas. This smart way of developing Free Zones has helped the UAE’s economy grow beyond just oil and gas.

Now, the UAE has over 40 Free Zones. They have brought in billions of dollars in foreign investment. These Free Zones show the UAE’s promise to create a strong, business-friendly environment that supports innovation and economic development.

Key Advantages of Establishing a Business in Dubai Free Zones

Dubai’s Free Zones create a great place for businesses. They attract foreign investors and help the economy grow. A big benefit is that these zones allow 100% foreign ownership. This means businesses can manage everything themselves. This is different from mainland companies, where foreign ownership rules can limit control.

Another big plus for companies in Free Zones is the tax-friendly setup. These zones usually do not charge corporate and personal income taxes. This helps businesses keep more of their profits, so they can invest in growth. This tax system lowers operational costs and boosts profits.

Also, it’s easier to do business in Dubai’s Free Zones. The local authorities have made simple and clear processes for getting registered and licensed. They also make visa processing easy. This helps companies start quickly and without much trouble.

Detailed Overview of Free Zone Areas in Dubai

Dubai’s Free Zones are varied and serve different industries. Each zone provides special benefits for businesses. Whether it’s media, technology, logistics, or finance, these areas are made to help companies grow.

A business may need modern facilities, highly skilled workers, or a strong network of other businesses. Dubai’s Free Zones offer solutions that fit those needs. This clear focus has made Dubai well-known as a global center for new ideas and entrepreneurship.

Sector-Specific Free Zones and Their Benefits

Dubai is strongly focused on helping growth in many sectors. This is clear from the creation of specific Free Zones. Each zone meets the needs of different industries. They provide special incentives, good infrastructure, and a helpful network to support business success. This smart plan has made a lively space where businesses can do well in their own area.

For example, Dubai Media City shows the emirate’s focus on media and content creation. It attracts both big media companies and smaller production houses. Similarly, Dubai Internet City and Dubai Silicon Oasis are busy spots for technology and innovation. They create a friendly space for both new startups and well-known tech companies.

Here are some key advantages of sector-specific Free Zones:

- Access to Specialized Talent: These zones bring in experts with specific skills. This means businesses can find very skilled workers.

- Tailored Infrastructure: Free Zones have infrastructure made for their industry’s needs. This includes media production sites or tech parks.

- Industry Networking Opportunities: Businesses can meet key people in their fields through workshops, conferences, and networking events.

Geographic and Strategic Importance of Each Free Zone

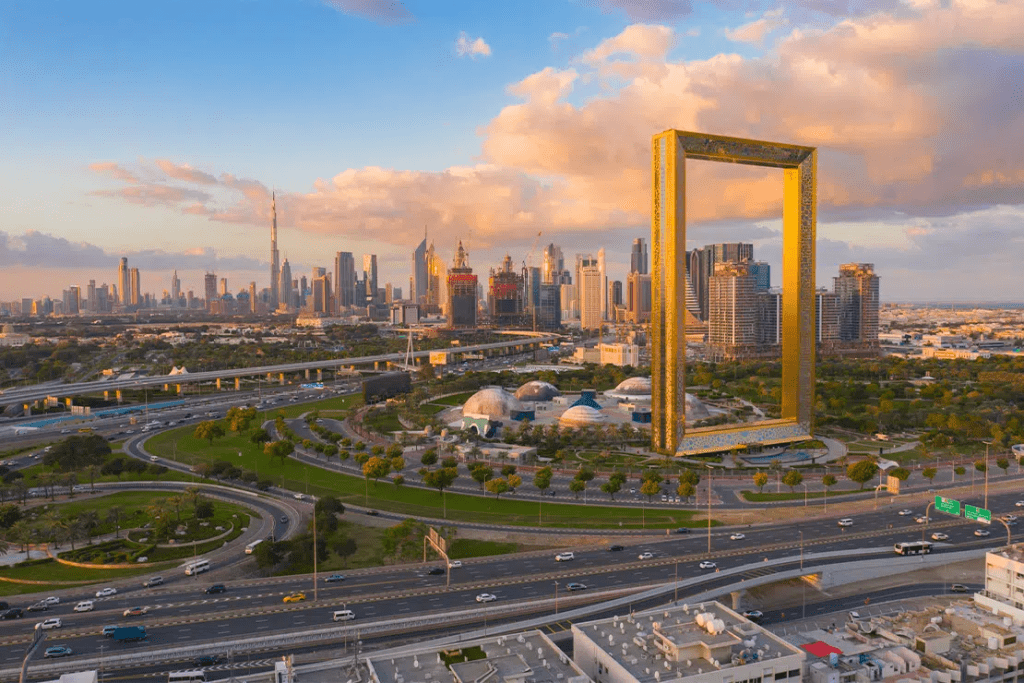

Dubai is located in a key spot where Europe, Asia, and Africa meet. This makes it a great center for global trade and business. Each Free Zone in Dubai adds to this benefit. They are close to important transport points like Dubai International Airport and Jebel Ali Port. Businesses in these zones get quick connections and smooth supply chain management.

For example, the Dubai Airport Free Zone (DAFZA) is right next to one of the busiest airports in the world. This helps move goods and people easily. The Jebel Ali Free Zone (JAFZA) is close to the Jebel Ali Port, the largest container port in the Middle East. This is a great place for logistics, manufacturing, and trading.

| Free Zone | Location | Strategic Advantages |

| Dubai Airport Free Zone (DAFZA) | Next to Dubai International Airport | Global connectivity, air cargo hub, easy customs processes |

| Jebel Ali Free Zone (JAFZA) | Near Jebel Ali Port | Access to a major seaport, logistics hub, strong infrastructure |

| Dubai Multi Commodities Centre (DMCC) | Jumeirah Lakes Towers (JLT) | Hub for trading goods, financial services, great business spot |

Legal and Regulatory Considerations for Free Zone Companies

Operating a business in Dubai’s Free Zones involves important legal and regulatory rules. It’s key to know these rules to stay compliant and avoid problems. Free Zones offer a lot of freedom, but companies still need to follow the specific regulations made by the Free Zone authority.

These regulations cover areas like setting up a company, getting licenses, taxation, employment, and protecting intellectual property rights. By learning about the legal framework of your chosen Free Zone, you can run your business smoothly and follow the local rules.

Understanding the Legal Structure Options in Free Zones

The legal rules for Dubai’s Free Zones give foreign investors different ways to set up their companies. Choosing the right setup depends on things like the business type, company size, and number of owners. Each option has its own benefits and legal effects, so it’s important to make a good choice.

One common option is the Free Zone Establishment (FZE). This setup is made for businesses with one owner. It is perfect for sole proprietorships, small business owners, and entrepreneurs who want an easy ownership setup. On the other hand, the Free Zone Company (FZCO) can have more than one owner and works like a limited liability company. This option is good for bigger businesses, joint ventures, and those looking for investment from outside.

It’s important to understand how each legal structure affects taxes, liability, and ownership when starting a business in a Dubai Free Zone. Getting legal advice can help you choose the best option that fits your needs.

Compliance and Regulatory Framework Specific to Free Zones

While the Free Zones in Dubai have their own rules, these rules still fall under UAE federal laws. It’s important to understand both to follow the laws correctly and avoid any legal issues. Each Free Zone authority is in charge of understanding and enforcing the rules specific to that zone.

Each Free Zone authority provides clear guidelines about what you need to do for your business. These guidelines include how to get licenses, pay taxes, hire staff, and follow rules for your industry. Keeping up with these guidelines is very important for keeping your operating license and running your business smoothly.

When starting your business, it’s a good idea to connect with your Free Zone authority. Their team can offer helpful information, explain any confusing rules, and help you with the necessary steps. This proactive strategy will help you understand the rules better and stay fully compliant.

Steps to Set Up Your Business in a Dubai Free Zone

Setting up a business in a Dubai Free Zone is simple. Here are the key steps to follow:

- Choose your business activity.

- Pick a suitable Free Zone.

- Decide on your legal structure.

- Register your company.

- Get the necessary licenses.

The Free Zone authorities are there to help you. They offer guidance and support during the whole setup process. This makes it easier for new businesses to deal with legal and administrative tasks.

After these steps, businesses can set up their physical office space if they need one. They can also open bank accounts and get visas for their employees. The Dubai Free Zone system is efficient and clear. This means businesses can establish their presence without too many hassles in this busy global location.

Documentation and Approval Process Simplified

Dubai’s Free Zones focus on making it easy to start a business. They have simple paperwork and a fast approval process. While rules may change a little between zones, the basic steps are the same. You need to get initial approval, register your business, and get the right licenses. This easy approach helps set up a business quickly.

In the initial approval phase, you choose your Free Zone and submit an application. You need to include your planned business activity and legal structure. After approval, the Free Zone authority helps you register. This includes picking a trade name and providing details about your company, like its structure and who the shareholders are.

Once you register your Free Zone establishment, you can apply for licenses and permits to run your business. These could be trade licenses, import-export licenses, or other permits for specific industries. The Free Zone authority helps you understand the paperwork needed so your approval goes smoothly and quickly.

Financial Considerations: Fees, Capital Requirements, and More

Dubai’s Free Zones can offer great tax benefits. However, it is important to think about other financial costs. This includes fees for company registration, licensing, visas, and expenses for things like office rent and utilities. Knowing these costs from the start helps with good financial planning and budgeting.

The amount of capital you need depends on the type of business, its size, and the Free Zone you choose. Some Free Zones have minimum capital rules or paid-up share capital requirements. It is important to check these rules with the Free Zone authority before registering your company.

The good news is that Dubai has a strong financial services sector. They support businesses in Free Zones. Many banks provide banking solutions for Free Zone companies. This includes business accounts, trade finance, and other financial services.

In conclusion, Dubai’s Free Zones provide a great benefit for businesses. They have special zones for different sectors and helpful rules. It’s very important to understand the legal rules and requirements in order to set up your business successfully. The growth of Free Zones in the UAE shows that Dubai wants to help businesses thrive. If you want to start a business in these Free Zones, be ready for some startup costs and make sure to follow the rules. The easier paperwork and financial help mean that starting your business in Dubai’s Free Zones could be a smart choice. Look into the chances these Free Zones can give for your business growth.

Frequently Asked Questions

What Are the Initial Costs Involved in Setting Up a Free Zone Company?

The starting costs for free zone companies in Dubai include a few things. These are trade name registration, licensing fees, visa processing, office rent, and other operational costs. It is vital to choose a free zone and know its fee structure right from the beginning.

Also Read: Exploring UAE’s Rising Markets: What’s Next?

Top UAE Packages

Related Articles

Top UAE Packages